The 5 C’s of Lending

October 18, 2023

Talent and the Board of Directors – pressing issues in an ever changing world.

November 2, 2023Borrowing from a Neobank - Who are they and what do they offer?

A Neobank is a type of digital bank that operates exclusively online without any physical branch locations. Neobanks offer services like checking and savings accounts, loans, credit cards, and other financial products, typically with low fees and competitive interest rates. They use technology to provide a seamless and convenient banking experience to their customers, with features like mobile banking apps, instant money transfers, and real-time spending alerts. Neobanks have gained popularity in recent years, especially among younger generations who prefer digital banking solutions over traditional banks.

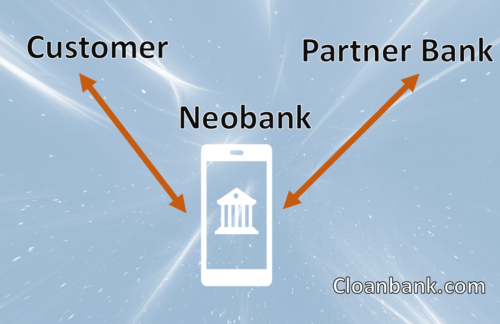

Typically, a Neobank will not have a traditional bank charter and not be licensed with the FDIC. Instead, they partner with an FDIC insured bank and in this way are able to offer customers insurance on deposits. The partner relationship usually entails a referral arrangement. This often takes the form of the Neobank marketing a menu of services and products that they have negotiated with the FDIC partner bank. Once a suite of service and products are agreed upon, the Neobank will market these to customers and potential customers. A white label alliance is sometimes granted. In this scenario, the branding of service and products show the Neobank entity, with a small disclaimer stating that all deposits are FDIC insured via the partner bank.

This relationship is advantageous to both parties. The Neobank receives an income stream via referral fees from the partner bank. In return, the partner bank gets new customers without the need for marketing to them directly.

Neobanks are not just limited to providing basic banking services. Many Neobanks are now offering lending services as well, such as personal loans and credit lines. By leveraging technology and data analytics, Neobanks are able to streamline the lending process and offer faster approval times. Perhaps one of the most important aspects of a Neobank are its deposits.

To start with, it is important to understand the concept of deposits. Deposits refer to the money that is put into a bank account by a customer. Banks use these deposits to fund their various operations and also to lend money to borrowers. Deposits can either be in the form of savings accounts, checking accounts, or certificate of deposit (CD) accounts.

When a bank has more deposits, it has more money to lend out to borrowers. This increased supply of funds leads to a decrease in the cost of borrowing. This is because, with more money available to lend, banks are able to lower their interest rates to attract more borrowers. This is where the correlation between lower cost deposits and lower loan rates comes into play.

For instance, if a bank has a high demand for loans but a low supply of deposits, it will have to increase its interest rates on loans to attract more deposits. On the other hand, if a bank has a lot of deposits, it can afford to lower its interest rates on loans since it has more money to lend.

Lower loan rates are beneficial for businesses as it means they can borrow money at a lower cost, which leads to lower interest payments and ultimately, lower costs of doing business. This is especially important for businesses that rely on borrowing to finance their operations.

In the case of Neobanks, they may be able to offer more flexible repayment terms and lower interest rates compared to traditional lenders because of lower cost deposits.

Lower cost of deposits refers to the ability of a financial institution to acquire funds from depositors at a lower cost. This can be achieved through various means, such as offering lower interest rates on deposits, offering unique deposit accounts, or implementing other cost-saving measures. A lower cost of deposits can have several benefits for a financial institution, such as increased profitability, improved liquidity, and greater flexibility in offering loans and other financial products. By reducing the cost of deposits, a financial institution can better serve its customers and position itself for long-term success in the industry.

For Neobanks, the decreased overhead in having a network of brick and mortar branches allows a lower cost of deposits. In turn, this lower cost of deposits can empower them to offer very competitive loan rates. Knowing this dynamic and taking advantage of it could save a borrower a significant amount of interest expense over the life of a loan.

It’s important to note that even though you may be dealing with a Neobank, it is a lender and lenders must comply with various regulations and guidelines when evaluating loan applications. These may include state and federal laws, as well as industry-specific standards and best practices. As a borrower, it’s important to be aware of the regulations that apply to your loan application, and to work with a lender who is transparent and upfront about their own compliance procedures.

On top of needing to comply with regulations, a Neobank will usually make a lending decision based on the 5 C’s of lending.

Neobanks may be the future of banking. By operating entirely online and without physical branches, they provide a more convenient and accessible banking experience. With features such as mobile banking, budgeting tools, and fee-free transactions, Neobanks offer users unbeatable convenience. Additionally, Neobanks can offer competitive interest rates and low fees, making them a more affordable option compared to traditional banks.